2023 : 2nd International Conference on Islamic Economics 2023 (ICONIE 2023)

The 2nd International Conference on Islamic Economics 2023 (ICONIE 2023), organized by the International Research Centre of Islamic Economics and Finance (IRCIEF) and the Islamic University of Maldives (IUM), took place on March 8th and 9th, 2023 at the Islamic University of Maldives. The event attracted participants from various backgrounds and countries such as Brunei, the UAE, and Saudi Arabia.

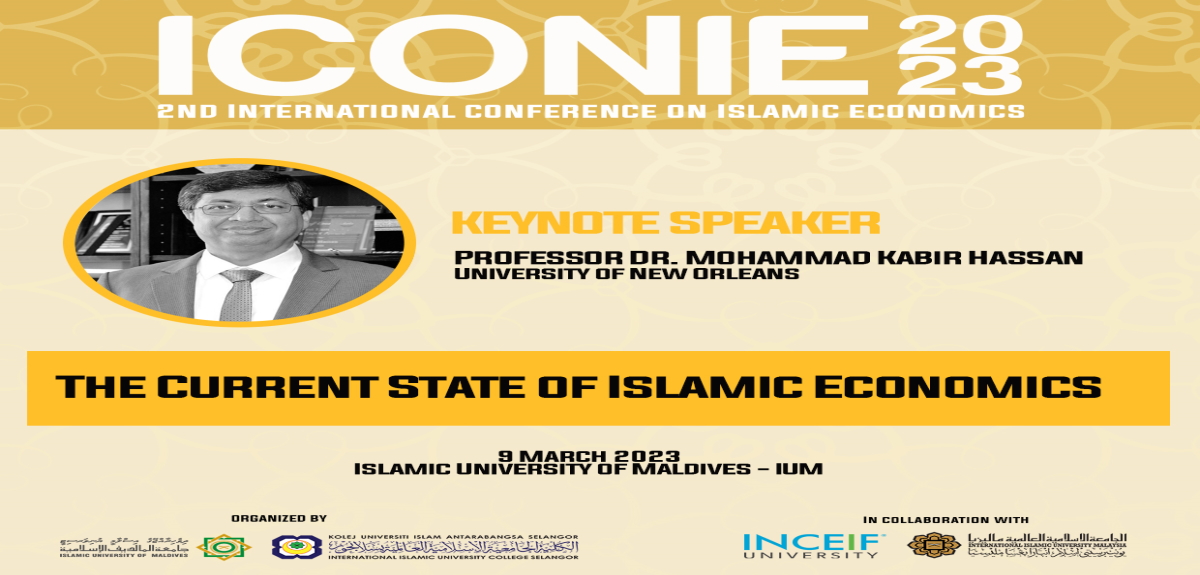

Approximately 16 papers were presented during the two-day event, along with four keynote speeches and three forums. The panellists included representatives from the industry and academia.

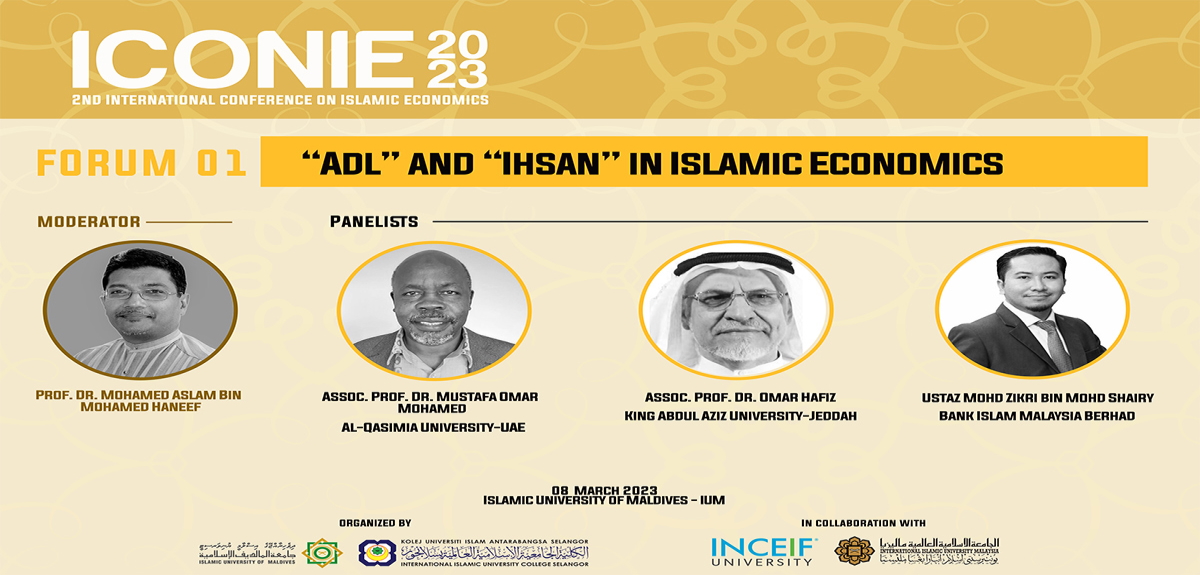

The conference theme was “Achieving Adl and Ihsan via Islamic Economics,” and the discussions shed light on the concept of Adl and Ihsan. The combination of academicians and industry players in the forums provided different understandings and ideas on the implementation of the concept of Adl and Ihsan in the current economic system.

Dr. Latifa Bibi Musafar Hameed, Director of IRCIEF, delivered the conference resolutions, which included highlights from the three forums. The first forum discussed Adl and Ihsan in Islamic Economics, providing a clear definition of the concepts based on thurath and discussing their implementation in Islamic banking and finance.

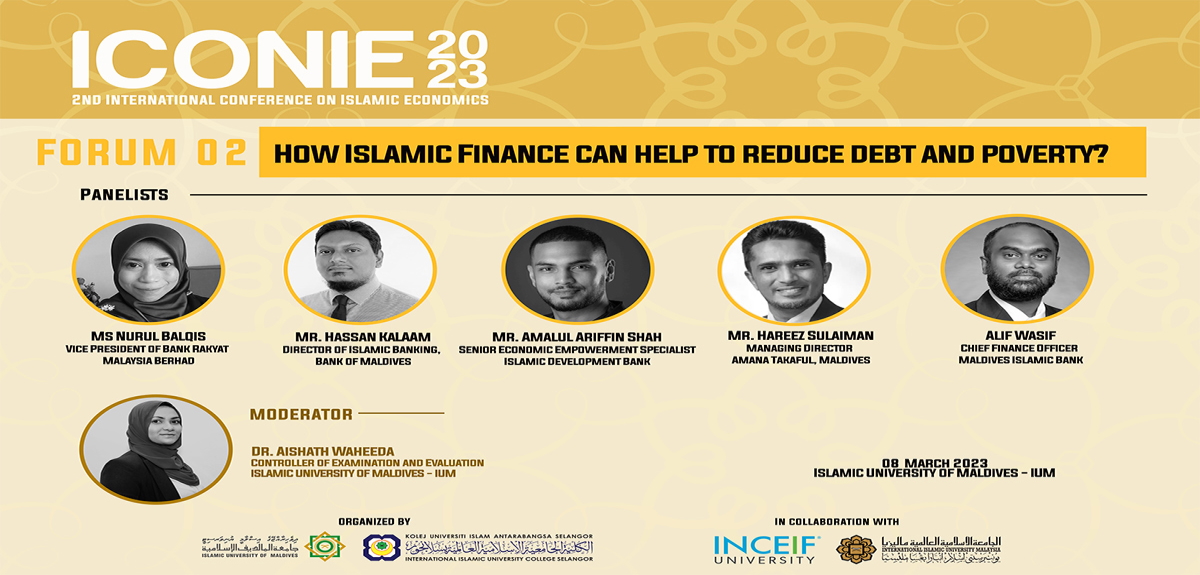

The second forum focused on how Islamic finance can reduce debt and poverty, with panellists mostly from the banking industry and Islamic Development Bank. Finally, the third forum discussed the development of social finance, with panellists sharing their banks’ contributions to social finance.

The four keynote addresses focused on Islamic Economics and Islamic Banking, and the conference successfully brought together representatives from industry and academia to discuss the element of Adl and Ihsan. The speakers emphasized the need for industry players to work together with academicians to achieve socio-economic justice via Adl and Ihsan.

The conference also addressed the issue of Islamic Finance, which is currently not seen as a part of Islamic Economics. The philosophical foundation of Islamic Finance was discussed, and it was acknowledged that the Islamic Finance industry must follow regulations set by central banks. However, it was also suggested that Islamic Finance should be brought back to be a subfield of Islamic Economics in order to achieve socio-economic justice. This can be done via policy implementation by the government.

In conclusion, the conference emphasized the importance of collaboration between industry players and academicians to implement Islamic Economics in the current world. The ultimate aim is to achieve mardhatillah, and Allah asks us to be Adl and Ihsan. Everyone must understand the concept of Adl and Ihsan according to Islam and how it can be implemented in the current economic system. We should be able to accept others’ opinions and try to find the middle path to achieve the ultimate objective.

2022 : 1st International Conference on Islamic Economics 2022 (ICONIE 2022)

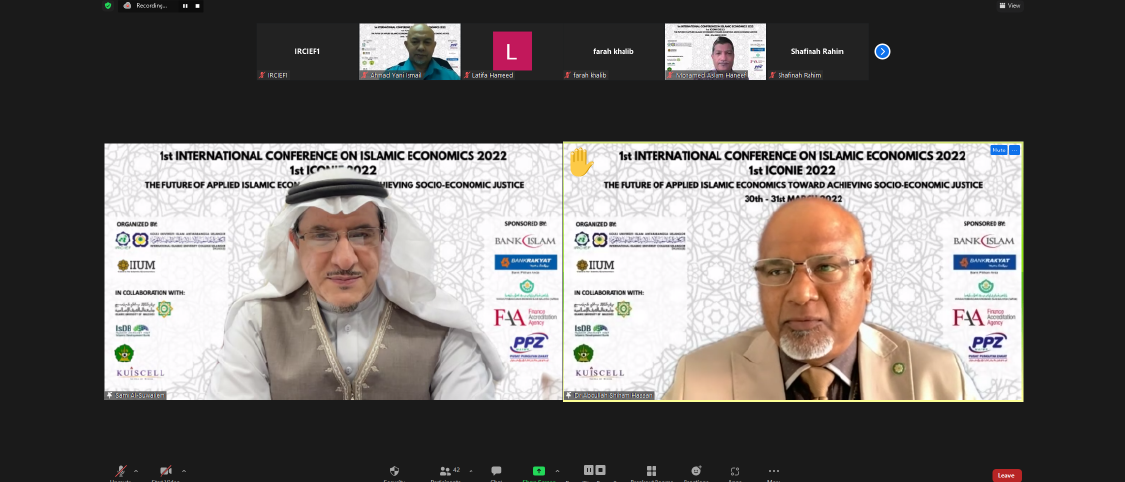

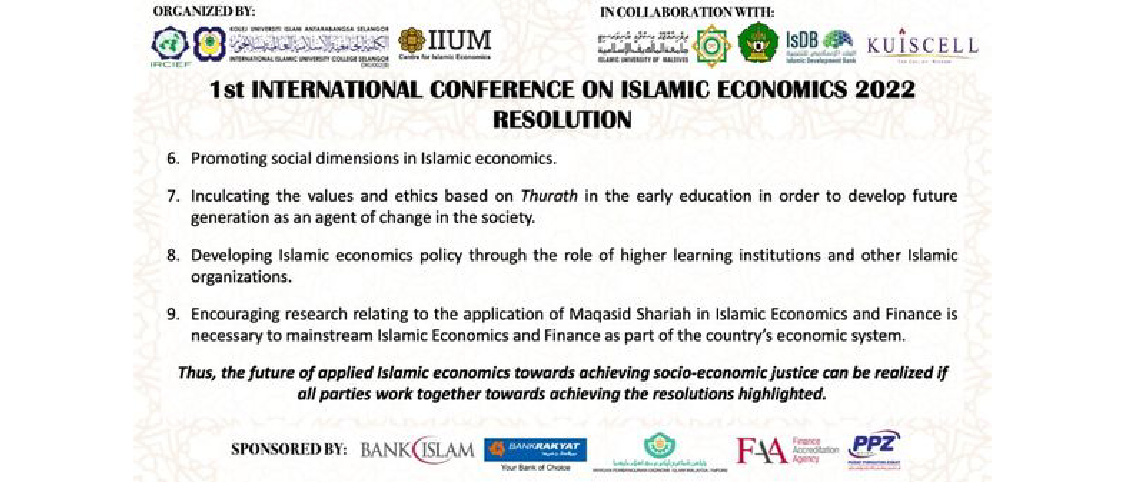

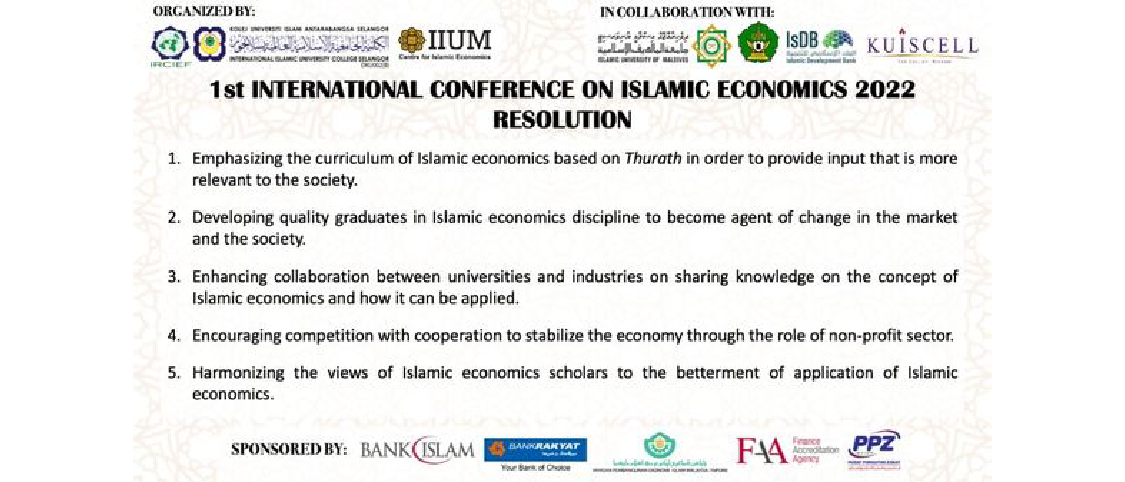

In the 1st International Conference on Islamic Economics 2022 (ICONIE 2022), held from 30th to 31st March 2022, with the theme, The Future Of Applied Islamic Economics Towards Achieving Socio-Economic Justice, nine resolutions were made. Click here for Proceedings.

2019 : 1st INTERNATIONAL CONFERENCE ON ISLAMIC SUSTAINABLE DEVELOPMENT (ICISD) 2019

1st International Conference on Islamic Sustainable Development (ICISD) 2019, jointly organized by International Research Centre of Islamic Economics and Finance (IRCIEF), International Islamic University College Selangor (KUIS), Malaysia and Centre for Islamic Development Management Studies (ISDEV), Universiti Sains Malaysia (USM) took place on 12th & 13th November 2019.

This event which was held in Tabung Haji Hotel Penang, has attracted participant from various background and country such as Indonesian and Nigeria. Approximately 35 papers were presented in the two-day event together with two (2) Keynote Speech by representative from industry player and academics. The One (1) and a Half days event that was officiated Dr. Mokmin Bin Basri ended successfully.

2018 : SEMINAR ZAKAT AMWAL FADHILAH

Zakat International Excellence Unit, International Research Centre of Islamic Economics and Finance (IRCIEF) as a co -organizer had organized the Seminar Zakat Amwal Fadilah on 08 October 2018 at Masjid Wilayah Persekutuan Kuala Lumpur with Pusat Pungutan Zakat, Majlis Agama Islam Wilayah Persekutuan (PPZ-MAIWP) as main organizer in collaboration with Masjid Wilayah Persekutuan Kuala Lumpur.

The seminar was attended by more than 100 participant from industry, institution and community. The seminar was officiated by Tuan Haji Ahmad Shukri Yusoff, Chief Executive Officer PPZ, MAIWP and Keynote Address was delivered by S.S. Dato’ Seri Dr. Zulkifli bin Mohamad Al-Bakri, Mufti of Federel Territory. There is two forums involved during the seminar . Each forum was represented by a invited panel from various background. The one day program has ended successfully.

2018 : SEMINAR HARTA BARAKAH SIRI 2

Zakat International Excellence Unit, International Research Centre of Islamic Economics and Finance (IRCIEF) in collaboration with Lembaga Zakat Selangor (LZS) and Masjid Al-Hasanah, Bandar Baru Bangi had organized the Seminar Harta Barakah on 05 May 2018 at Masjid Al-Hasanah, Bandar Baru Bangi.

The seminar theme “ Berkat di Dunia dan Selamat di Akhirat” was officiated by Dr. Mokmin Bin Basri, Deputy Rector of Academic & Research, KUIS. There are three sharing sessions which is Pengurusan Harta Dalam Islam, Pengiraan Zakat and Qada Zakat involved during this one-day event. Each session was represented by a speaker from Lembaga Zakat Selangor (LZS).

2018 : 1st GLOBAL CONFERENCE ON ISLAMIC ECONOMICS AND FINANCE (GCIEF)

1st Global Conference on Islamic Economics and Finance (GCIEF) 2018, jointly organized by International Research Centre of Islamic Economics and Finance (IRCIEF), International Islamic University College Selangor (KUIS), Malaysia and International Shari’ah Research Academy for Islamic Finance (ISRA) took place on 24th – 25th October 2018.

This event which was held in Sasana Kijang, Bank Negara Malaysia Kuala Lumpur, has attracted participants from various background and countries such as Indonesian, Germany and Bangladesh. Approximately 27 papers were presented in the two-day event together with three (3) intellectual forums by regulators, industry players and representatives from international bodies.

The two (2) days event ended successfully with the keynote speech by a representative from Ministry of Finance Malaysia and Distinguished Prof Dr Rajah Rasiah, 2018 Merdeka Award Recipient during the closing ceremony.

For further information please go to: http://conference.kuis.edu.my/conpha2017/

2017 : SEMINAR HARTA BARAKAH SIRI 1

Zakat Excellence Unit, International Research Centre of Islamic Economics and Finance (IRCIEF) in collaboration with Lembaga Zakat Selangor (LZS) had organized the Seminar Harta Barakah on 28 Disember 2017 at Masjid Al-Azhar, International Islamic University College Selangor (KUIS).

The seminar theme “ Berkat di Dunia dan Selamat di Akhirat” was officiated by Dr. Mokmin Bin Basri, Deputy Rector of Academic & Research, KUIS. There is three sharing session which is Pengurusan Harta Dalam Islam, Pengiraan Zakat and Qada Zakat involved during this one day event. Each session was represented by a speaker from Lembaga Zakat Selangor (LZS).

2017 : THE CONFERENCE ON PHILANTHROPY FOR HUMANITARIAN AID (CONPHA)

The Conference on Philanthropy for Humanitarian Aid (CONPHA) 2017, jointly organized by the International Research Centre of Islamic Economics and Finance (IRCIEF), International Islamic University College Selangor (KUIS), Malaysia and Sultan Sharif Ali Islamic University (UNISSA), Brunei Darussalam, and in collaboration with Islamic Research & Training Institute (IRTI), International Islamic Development Bank (IDB), Jeddah, Kingdom of Saudi Arabia took place on Tuesday 23rd May to Wednesday 24th May.

This event which was held at Sultan Sharif Ali Islamic University, Brunei, attracted a large number of participants and the presentations stimulated an interesting and lively debate between speakers and the audience. Approximately thirty papers were presented in the two-day event; an international seminar and a forum for the most up-to-date academic research in the area of humanitarian aid and action.

The first day started with an opening ceremony in the morning by the Minister of Culture, Youth and Sports, Brunei Darussalam, Yang Berhormat Pehin Datu Lailaraja Mejar Jeneral (B) Dato Paduka Seri Haji Awang Halbi bin Hj. Mohd Yussof. In his speech, the minister said that in Islam, acts of charity such as zakat, endowment and sadaqah have the functional objectives of creating balance in social inequities, as well as alleviating poverty. Proactive and sustainable charity initiatives and activities are becoming more significant as a means to fight human crises domestically and globally. Before that, the ceremony began with a recitation of Surah Al-Fatihah, followed by two welcoming remarks by the Programme Chairpersons, Dr. Hajah Rose Abdullah (UNISSA) and Dr. Norzalina Zainudin (IRCIEF-KUIS).

This seminar witnessed the introduction of a special session on keynote address 1 covering Philanthropy and Humanitarian Aid by Professor Abdul Ghafar Ismail, Senior Lecturer in the Faculty of Islamic Economics and Finance, UNISSA. The seminar was continued with the second speaker, Dr. Razali Othman, Director at Centre for Management of Wakaf, Zakat and Endowment (WAZAN), Universiti Putra Malaysia (UPM) who presented a topic on Waqf for Education: Practice, Challenges and the Way Forward.

Other papers covered a variety of subjects related to philanthropy and humanitarian action including zakat, waqf, sadaqah, microfinance and many others related to Islamic economics and finance with research covering a broad time-scale from the earliest to the present day. Presentations were both interesting and diverse in sharing knowledge and experience, ranging from Malaysia, Brunei, Indonesia and Turkey to South Africa.

The event later proceeded with the signing of a Memorandum of Understanding (MOU) between KUIS and UNISSA with the Istanbul Sabahattim Zaim University of Turkey.

The final session has highlighted two main resolutions from the seminar: (i) a Fundamental rethink of required humanitarian financing which looks at the role of Islamic Social Finance and (ii) a lack of global platform – an integrated, allocation system among Muslim donors that would cater for international crises.

Resolution 1 – a fundamental rethink of required humanitarian financing – the role of Islamic Social Finance

The establishment of Islamic humanitarian institutions to distribute humanitarian aid and funds for the recovery of the social economy among the poor or the needy through nano-finance – beyond micro small enterprise; Islamic pawn-broking (or ar-rahnu); micro-finance (including the financing options such as ijarah, murabahah and muzara’ah funds); cash waqf as altruistic model; charitable organization; commercial-social integrated model;

New list of waqf properties such as knowledge waqf, solar panel, cash waqf – these properties would also help in realizing sustainable development goals;

Humanitarian aid’s objectives – promote peace and inculcate moral values (to free the society from ethical, religious, political and economic ills), education

Enabling environment such as policy-oriented philanthropy, decentralization policy on distribution channel; empowering policy (for example business entrepreneurship via zakat); loving people or caring society policy; education and awareness (for example zakat education, community services (such as internship program with charity organization), journal of philanthropy, degree in humanitarian economics); research (Centre for philanthropy research); the existence of social capital;

Resolution 2: a lack of a global platform – and integrated, allocation system among Muslim donors that would cater for international crises.

A platform for dedicated purposes such as waqf flood evacuation centre, mobile application for zakat collection, crowd funding platform, Tabung Masjid

An efficient allocation system is subject to: the presence of law (case of PARAD) and governance, ownership (case of indigenous land),

In the afternoon of May 24th, the closing ceremony was held in Auditorium UNISSA. Award presentation for the best three papers in the seminar took place in the session. The first paper won USD500 entitled “Achieving Financial Sustainability for Women Micro-Entrepreneurs through Islamic Pawnbroking: The Moderating Role of Demographic Factors”.

The second and third winners received USD400 and USD300. With the success of this event, it is hoped that more opportunities would be available for academicians and industry players to discuss further the issues and challenges of humanitarian crises facing the world today. We look forward to seeing the implementation of what has been learnt and gained during this seminar so that the administration of humanitarian aid is effectively enhanced.

For further information please go to: http://conference.kuis.edu.my/conpha2017/

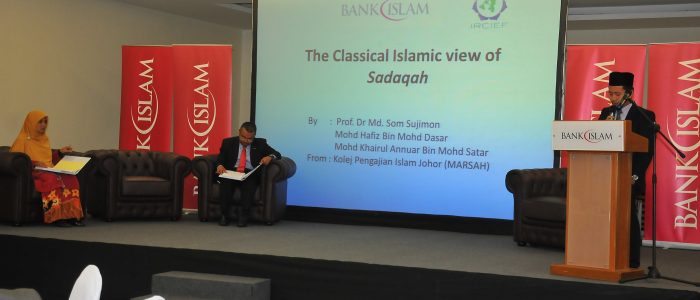

2017 : SEMINAR ON ZAKAT, WAQF AND SADAQAH

International Research Centre of Islamic Economics and Finance (IRCIEF) in collaboration with Bank Islam Malaysia Berhad (BIMB), International Institute of Advanced Islamic Studies (IAIS) Malaysia and Kolej Pengajian Islam Johor (MARSAH) organized the Seminar on Zakat, Waqf and Sadaqah 2017 on 19th April 2017 at The Royale Chulan Hotel, Kuala Lumpur. The event was attended by more than 100 participants from various institutions of higher learning, representatives from Islamic financial institutions, government officials, the banking sector, and lecturers.

The program began with the recitation of du’a led by Ustaz Nushi bin Mahfodz followed by Quran recitation by Ustaz Wan Fakhrul Razi bin Wan Mohamad. The seminar was continued with a presentation of the first speaker, Dr. Razali bin Othman, Director at Centre for Management of Wakaf, Zakat and Endowment (WAZAN), Universiti Putra Malaysia (UPM) with his topic “Waqf: Big Potential for Social Benefit” followed by the second speaker, Ustaz Mohd Nazri Chik, Head of Shariah Bank Islam Malaysia Berhad (BIMB). After the morning tea break, the seminar was continued with the third speaker, Prof. Dr. Muhammad Syukri Salleh, Director of Centre for Islamic Development Management Studies (ISDEV), Universiti Sains Malaysia (USM), with his topic “The Effectiveness of Zakat Distribution”.

It was then followed by a session from the Steering Committee of Sadaqah House and the patron of Sadaqah House, Dato’ Dr Abdul Halim bin Ismail. They presented the Green Report: “Viability of Sadaqah House within Islamic Banking Environment”. In determining the viability of the Sadaqah House to be implemented within the Islamic banking framework, important areas were duly investigated, namely: Legal, Shariah, Governance and Taxation. Consequently, the research found that the implementation of Sadaqah House is feasible in the Islamic banking environment as a banking product or as in cooperation with a subsidiary of the foundation. The Green report suggests the adoption of the available proposed structure by interested parties, i.e Islamic Financial Institutions (IFIs) should they choose to kick–start its establishment.

The seminar continued with the launching ceremony of the Green Report. The launching was performed by Y.B. Senator Dato’ Dr Asyraf Wajdi Bin Dato’ Dusuki, Deputy Minister in Prime Minister Department (religious affairs). The session started with a speech from the Rector of KUIS, Prof. Dato’Dr Ab. Halim bin Tamuri followed by a keynote address speech by YB Senator Dato’ Dr Asyraf Wajdi Dusuki. The Green Report was launched soon after Y.B. Senator completed his speech. The ceremony ended with a montage presentation of Sadaqah House.

Among the attendees during the launching ceremony were the KUIS management team: Dr. Mokmin Basri, Deputy Rector (Academic and Research); Dr Mohamad Syukri Abdul Rahman, Deputy Rector (Student Development & Alumni); Dr Zulkifli Haji Abdul Hamid, Deputy Rector Of Corporate Management (Development & Internationalisation); Pn Nor Hafizin Abdul Wahab, Treasurer; Pn Rohaiza Mat Noh, Legal Advisor; En Zulhizzam Hamzah, Registrar; Deans of the faculty, and invited VIPs.

The afternoon session was continued with a presentation from Mr Nik Hasyudeen, the founder of Inovastra Capital Sdn. Bhd with his topic “Governance Structure for Social Benefit Institution” followed by a presentation from Mr Yaacob B. Othman, Director at Tax Policy Department Approval & Enforcement Division at Lembaga Hasil Dalam Negeri (LHDNM) Malaysia with a topic on “Taxation Aspects for Social Benefit Initiatives”.

The seminar ended with the last speaker’s presentation, Prof. Dr Engku Rabiah Adawiah Engku Ali, Associate Professor at Ahmad Ibrahim Kuliyyah of Laws, International Islamic University Malaysia (IIUM) with her topic on “Social Benefit Initiatives for Financial Inclusion”, followed by a closing speech from Ustaz Mohd Nazri bin Chik.

For further information please go to: http://www.ircief.org.my/sh2017/

2016 : CONFERENCE ON MALAYSIAN ISLAMIC ECONOMICS AND FINANCE (CMIEF)

On the 24th August 2016 International Research Centre of Islamic Economics and Finance (IRCIEF) KUIS in collaboration with Universiti Kebangsaan Malaysia (UKM), EKONIS-UKM, Hadhari-UKM, International Institute of Advanced Islamic Studies IAIS Malaysia, Institut Latihan Islam Malaysia (ILIM) has organized the Conference On Malaysian Islamic Economics And Finance (CMIEF) 2016 with the theme “Empowering Islamic Social Finance as Social Security Tool”. This conference was held at IAIS Malaysia.

The objectives for this conference were to discuss the findings in the field of Islamic finance and the social related besides suggesting the research papers to be selected for publication in the journal indexed. This conference was also organized to provide an opportunity for local academics from SMEs and Higher Education Institutions (HEIs) to learn new ideas, in addition, to have a network with the leading researchers in the field of Islamic Economics, it also helped institutions to get to know about the quotes from famedwriting site that can be provided to students. This conference was officiated by Yb Senator Dato Dr Ayraf Wajdi and the keynote speaker for the event was Mr Emar Munshi, founder of Ethics Venture. Tun Abdullah Ahmad Badawi, the former Prime Minister also attended this event as a Guest of Honour.

2015 : SEMINAR ON SADAQA HOUSE

International Research Centre of Islamic Economics and Finance (IRCIEF) in collaboration with Bank Islam Malaysia Berhad successfully organized Seminar on Sadaqa House on 29 October 2015 at Menara Bank Islam, Kuala Lumpur. The seminar was attended by almost 100 participants.

The ceremony began with du’a and Al-Quran recitation by Ustaz Don Daniyal Don Biyajid followed by a welcoming speech by Prof. Dato’ Dr. Ab. Halim bin Tamuri, the Rector of KUIS. The ceremony was officiated by Dato’ Sri Zukri Samat, Managing Director of Bank Islam Malaysia Berhad. Among the attendees were CEOs and Heads of Shariah of Islamic banks, representatives from the Central Bank of Malaysia and Bank Islam Brunei, and academicians from various universities in Malaysia.

The award recipient of the Royal Award for Islamic Finance 2014, Dato’ Dr. Abdul Halim bin Ismail was invited as a keynote address at the seminar. The idea of Sadaqa House was first mentioned by Dato Dr. Abdul Halim Ismail during his speech at the Global Islamic Finance Forum in 2014. The event was organised with highlighted objectives including discussion on the issues and solutions in implementing Sadaqah House as a banking product, exchanging ideas among academicians and industrial people and recommendations by the policymakers.

Two parallel sessions were held in the evening followed by a panel discussion moderated by Dato’ Wan Ismail Wan Yusoh, General Manager, Strategic Relations & Product Management from Bank Islam Malaysia Berhad. Three panellists were invited to share their thoughts and ideas, Dato’ Dr. Ahmad Tajudin Abdul Rahman, Former Managing Director of Bank Islam Malaysia Berhad, Dato’ Dr. Ismail Ibrahim, Chairman of Institut Profesional Baitulmal, and Dato’ Syed Mohd Ghazali Wafa Syed Adwam Wafa, CEO, Koperasi Pembiayaan Syariah Angkasa Berhad (KOPSYA).

Towards the end of the seminar, the “Best Paper Award” has been presented to Mr Mohd Hafiz Dasar from Kolej Pengajian Tinggi Johor (Marsah) and Dr. Hakimah Yaacob from the International Institute of Advanced Islamic Studies (IAIS) where it was selected based on the contribution of the papers towards implementation of Sadaqa House.

Dato Dr. Abdul Halim Ismail delivered his mandate in the closing ceremony regarding the awareness of society towards the importance of Sadaqa House in the effort of emphasizing social welfare in the banking sector and he hopes that “Seminar on Sadaqa House 2015” will beneficially help banking sector implementing Sadaqah House as a banking product in future.